How Governments Steal Your Money and Conceal It Through Inflation

Article Contents

Iran Cuts Four Zeros From Hyperinflated Rial

According to recent media reports from Iran, the government in Tehran last week approved a major change to the country’s fiat currency presented by the Central Bank of Iran (CBI) back in January. Four zeros will be cut from the Iranian rial and it will also be completely replaced, gradually and over a two-year period, by a new currency going by an ancient name, the toman.

“The council of ministers, at a meeting presided by President Hassan Rouhani this morning, approved the central bank’s proposed bill to change the national currency from the rial to the toman and delete four zeros,” the Fars news agency reported on Wednesday. This decision was made “to maintain the efficiency of the national currency and facilitate and restore the role of cash instruments in domestic monetary transactions,” Fars added.

The Persian toman was used in the country until 1932 when it was replaced by the rial as the official currency. Out of habit, the people of Iran still use it as a monetary unit to this day to mean 10 rials, exactly at the rate it was replaced at almost 90 years ago. However, the new toman will be worth 100 rials, creating in effect another tenfold redenomination of the Iranian currency.

The real reason for the Iranian government’s move is that the rial has been suffering from severe inflation in the last couple of years, dropping to exchange rates as low as 190,000 rials per US dollar last September. During 2018 alone it has lost about 60% of its purchasing power, wiping out most of the value of people’s savings and earnings.

This process started in December 2017 when the Iranian government decided to cut interest rates on savings accounts in an effort to boost exports. It was kicked into high gear with the help of another round of U.S. financial sanctions over the country’s nuclear program.

The Iranian government later tried to correct course but its actions have been mostly futile and some have even backfired. For example, setting the official exchange rate at about 45,000 rials to USD caused a new online black market to spring up where people now use instant messaging apps to trade at real prices outside the control of the government and its approved money changers.

A Long History of Hiding Failure

Iran did not invent the idea of cutting zeros off its currency to hide its diminishing worth, of course, and it is just the latest in a long line of countries that have done the same over the years. In fact, fiat redenominations have being going on for over a century now, with some countries doing it over and over again whenever inflation pops up such as Brazil and Argentina. Sometimes it has coincided with an improvement of the local economy but often it has merely hastened its approaching collapse. In recent years this has been most notable in the case of countries suffering from hyperinflation such as Zimbabwe and Venezuela.

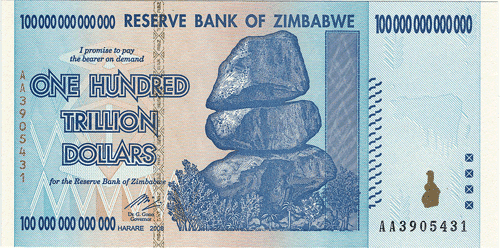

In February 2009 the government of Zimbabwe decided to cut 12 zeros from its currency, after the Zimbabwe dollar set a new world record in hyperinflation estimated to be in the billions of percent. This meant that 1 trillion in old Zimbabwe dollars was at once made equivalent to just one new Zimbabwe dollar. The step was taken after the old currency became basically useless as money, with even the highest notes of 100 trillion dollars not worth enough to buy a single loaf of bread. Just the year before, Zimbabwe already cut 10 zeros off its currency.

In August 2018 the Venezuelan government removed five zeros off its fiat as President Nicolas Maduro decided that the new “sovereign bolivar” would officially be worth 100,000 times the older bolivar. Just 10 years prior, Venezuela cut three zeros off its currency. Maduro also claims that the sovereign bolivar is backed by the dubious petro cryptocurrency he created.

Why Redenomination Fails to Make an Impact

Governments and central banks present several reasons for making such drastic redenominations. Some are practical, such as saving people the trouble of having to use a wheelbarrow full of paper money just to get a loaf of bread to feed their family.

Others are purely psychological, such as restoring ordinary people’s confidence in the national economy by making the currency look like it’s worth more in international terms. These appear to be more honest, as the real purpose is after all to hide the fact that the people in power have wiped out national savings through disastrous policies such as endless money printing.

According to economic research, redenomination has a long term impact on an economy only when it is accompanied by strong anti-inflationary financial steps and the removal of the economic policies causing the problem to begin with. Otherwise, the practice can backfire as people will see that the government can just remove as many zeros as it wants but inflation will keep biting, causing the populace to lose confidence and flee to more stable monetary options, further depressing the value of the local currency.

In the long term, the only foreseeable solution to preventing hyperinflation is to take the power to print money away from the state by transitioning to an inflation-resistant cryptocurrency-based monetary system.

I am Campurro, one of the founders of MonetaVerde Coin.