China-Based Bitcoin Miners Consider New Territories Due To Crackdown Fears

Article Contents

China’s Bitcoin mining industry is teetering on the edge of the abyss as miners fear the government’s crackdown will strike them next. Despite China not having expressed such intentions explicitly, the atmosphere in the industry remains tense. With many believing that it is simply a matter of time before their operations are forcefully halted, they are exploring their options abroad.

Outsourcing to Safer Crypto-Territories

The five prospective countries that appear on their collective lists are the United States, Vietnam, Thailand, Russia, and Laos, in no particular order.

As it appears, the widespread unease was sparked in the second week of November as a document imposing mining restrictions was circulated. The source was not the government itself in this case, but instead a subsidiary of the State Grid Corporation. In this decree, the country’s ability to sustain Bitcoin mining operations is uncertain and brought into question.

As allegations of the misuse of electricity surface, hydro-power stations are no longer permitted to supply electricity to Bitcoin miners. It is argued that power generated from these plants should be allocated to the poverty-stricken rural communities in the province, most notably during the dry season.

The State Grid Corporation later responded to the document that they believed had been misinterpreted. The company stated that it did not have the legal authority to ban Bitcoin mining, and merely commented on the mining industry about to the power demanded by it.

Bitcoin Crackdown & Relocation

A bitcoin crackdown has already been applied to exchanges and ICOs throughout the country earlier this year, and it has long been suspected that mining will soon join the list of banned bitcoin practices in China. This move would have a widespread effect on Bitcoin and Bitcoin Cash networks, as it is estimated that miners are responsible for between 70 to 80 percent of the hashrate distribution.

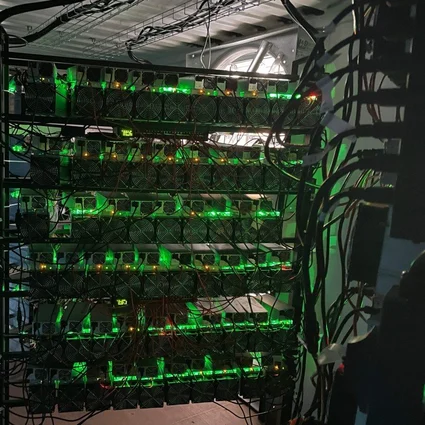

Warehouses in isolated parts of China’s Sichuan province house thousands of Bitcoin mining machines which run day and night. Chinese clients rent the use of the machines from the mine owners and can monitor their progress using applications on their smartphones.

According to the South China Morning Post, a Chinese Bitcoin miner has expressed that many miners have already paid a visit to the countries listed above with the intentions of purchasing mining sites and negotiating electricity prices with local suppliers. The miner in question, Akira Cui, went on to argue that regardless of the potential Bitcoin mining crackdown, the Chinese mining community was always bound to expand overseas. Mr. Cui was the sole miner who responded to the South China Morning Post.

He admits that there is a degree of corruption within the industry, which is one of the main reasons that mining company representatives choose not to speak with the media. According to him, it is not unheard of that miners negotiate underhand deals with local power companies that allow them decreased electricity rates – and these deals are usually kept secret from supervisors, high-ranking officials, and institutions. “No one brags about it because it’s best to make a fortune in silence,” he said.

Mining Profits & Losses

The average mining machine turns a profit of about $15 a day. For large-scale miners, the main hurdle is finding a reliable source of power, as an inactive apparatus incurs a financial loss for its owner.

As such, many miners aim to get the jump on the potential crackdown on the horizon, by relocating overseas beforehand. Should it happen sooner than they expect, Mr. Cui doesn’t foresee there being a significant problem, due to the steps that they have already put in place. He explains:

“If the regulators move to outlaw mining, it will only take us about three months to resume operations overseas. Money spent in buying land is a relatively small amount compared to the whole business.”

Interestingly, he is of the opinion that the crackdown would not hurt the cryptocurrency and bitcoin community as a whole. On the contrary, he believes that the aftermath would lead to a greater decentralization of the cryptocurrency, which falls in line with the fundamental principle behind it. He strongly expects it to find strength once it is forced to be less dependent on China.

I am Campurro, one of the founders of MonetaVerde Coin.